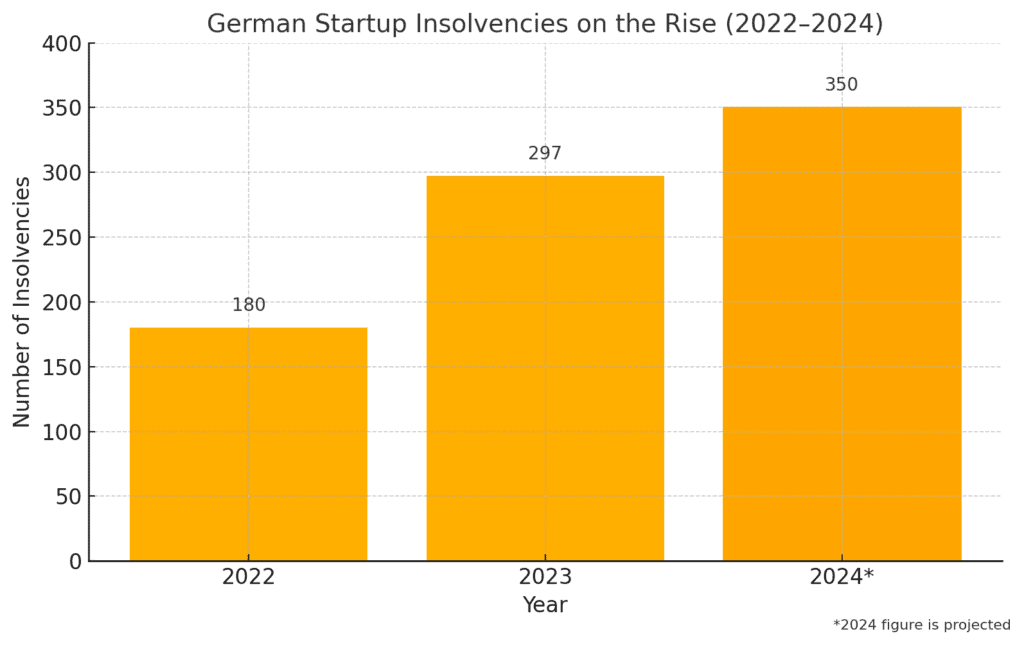

The roaring party in Berlin’s and Munich’s tech hubs is over. The era of blitzscaling on cheap venture capital has given way to a brutal hangover of cash burns, down rounds, and a rising tide of insolvencies.

According to the latest data from Germany’s Federal Statistical Office (Destatis), corporate insolvencies rose by 13.1% in Q1 2025 compared to the same period in 2024, with June 2025 alone seeing a 2.4% increase over the previous year—underscoring ongoing financial pressures that continue to impact startups and established businesses alike. High-profile unicorns are stumbling, and the once-celebrated founders are now locked in tense boardroom battles with their investors.

This isn’t just a market correction; it’s a fundamental reckoning forcing a wave of emergency M&A, shareholder litigation, and corporate restructurings. The shift from a zero-interest-rate environment to a landscape of expensive capital has fundamentally altered the power dynamic between founders and the venture capitalists who fund them.

The gold rush has just begun for Germany’s corporate law firms, as they become the indispensable navigators in these high-stakes rescue missions. The focus has pivoted sharply from “growth at all costs” to survival, making legal strategists the new kingmakers.

From Hyper-Growth to the Courthouse Steps

The transition from a “growth-at-all-costs” mindset fueled by zero-interest-rate policies to today’s harsh reality has created a capital famine. For years, German tech startups, aspiring to emulate their Silicon Valley counterparts, burned through cash in pursuit of market share, a strategy enabled by a constant flow of venture funding.

VCs are no longer writing blank checks; they’re demanding profitability, pulling term sheets, and pressuring portfolio companies to find a buyer or face the music. This pressure is immense, as investors look to salvage returns from their portfolios in a market where lucrative IPOs have all but vanished.

The collapse of London-based, but heavily European-focused, software company Builder.ai serves as a concrete cautionary tale for the entire ecosystem. After raising over $450 million and being celebrated as a major success story, the company fell into administration in 2024 after a critical $250 million funding round led by Microsoft failed to materialize, sending a chill through the market.

The swift implosion highlighted how even a heavily-funded, high-profile company can collapse into insolvency and legal disputes almost overnight when the capital spigot is turned off, leaving employees and smaller investors facing a total loss.

Source: Deutsche Welle

The Legal Playbook: Navigating Fire Sales and Founder Fights

The current market climate inevitably creates friction between founders with a long-term vision and VCs seeking a near-term exit to salvage their investment. This tension is playing out in boardrooms across Germany, with legal pressure points like drag-along rights, which force minority shareholders to accept a sale, being weaponized. Disputes overvaluations in “down rounds”—where a business raises capital at lower valuations than in its previous round—are becoming common, with complex liquidation preferences giving VCs downside protection at the direct expense of founders and employees.

For many distressed startups, a “fire sale” is the only alternative to a complete wipeout in insolvency court. These emergency M&A deals are executed under immense time pressure and legal complexity, with corporate buyers and private equity firms performing rapid-fire due diligence to hunt for bargains among the wreckage. The goal is no longer to find a “strategic fit” at a premium valuation but to acquire valuable technology, talent, or customer lists for pennies on the dollar before an insolvency administrator takes control and assets are liquidated.

For founders of a German GmbH facing this cliff edge, the options narrow to either a complex, often dilutive, bridge financing round or a swift exit. This has fueled the rise of specialized platforms that facilitate a quick GmbH verkaufen (selling a limited liability company), offering a lifeline to salvage some value before formal insolvency proceedings (and the associated liabilities for directors) begin. These are designed to address the complexities of a distressed sale, providing an alternative to a lengthy and often value-eroding liquidation process.

Key Legal Hurdles in a German Startup Rescue

Strict Insolvency Triggers (InsO): Unlike the US Chapter 11, German law has rigid triggers for insolvency filing (e.g., illiquidity or over-indebtedness), placing immense personal liability risk on managing directors (Geschäftsführer) if they delay.

Clawback Provisions (§ 135 InsO): The German Insolvency Code allows administrators to “claw back” payments made to shareholders (like loan repayments) before insolvency. This uniquely sharp tool, which has been the subject of recent referrals from Germany’s Federal Court of Justice (BGH) to the European Court of Justice, often surprises foreign investors.

Complex Employee Protections: Strong German labor laws make workforce restructuring during a crisis a legally fraught and expensive process compared to the at-will employment standard in the US, adding another layer of complexity to rescue deals.

Shareholder Consent and Notarization: Corporate actions, including emergency capital increases or asset sales, often require formal, notarized shareholder resolutions, a bureaucratic step that can dangerously slow down the pace of time-sensitive deals.

Not Your Father’s Silicon Valley: Germany’s Unique Crucible

The German market operates within a fundamentally different framework than its American counterpart. The European and German regulatory environment, from the EU AI Act to GDPR, creates a compliance minefield that adds significant cost and complexity. This has become a major point of contention for tech leaders, with executives at industrial giants like Siemens and enterprise software titan SAP publicly warning that over-regulation threatens to stifle innovation and put European companies at a global disadvantage.

Beyond regulation, there are deep-seated cultural and capital differences. German capital markets are traditionally more risk-averse, with a cultural stigma attached to business failure that is largely absent in Silicon Valley, where it is often framed as a learning experience.

Furthermore, a shifting geopolitical climate has made some US investors more skeptical of European ventures, pushing founders to seek capital closer to home from a smaller and more cautious pool of funds. These factors combine to create a uniquely challenging crucible for German tech startups.

Comparison table between startup ecosystems in Germany and Silicon Valley:

| Feature | Germany (Berlin/Munich) | USA (Silicon Valley) |

|---|---|---|

| Funding Culture | More conservative, emphasis on profitability, bank-led debt is common. | High-risk, high-reward equity focus; “blitzscaling” celebrated. |

| Legal Framework | Rigid corporate and insolvency laws (GmbHG, InsO), strong employee protections. | Flexible corporate structures (Delaware C-Corp), debtor-friendly bankruptcy (Chapter 11). |

| Exit Strategy | Often strategic acquisitions by industrial “Mittelstand” or larger European players. | IPOs and acquisitions by Big Tech giants are the primary goals. |

| Talent Incentives | Employee stock options (ESOPs/VSOPs) are legally complex and less common. | Stock options are a standard and powerful tool for talent acquisition. |

| Regulatory Burden | High; driven by EU-level mandates (GDPR, AI Act) and national laws. | Lower; primarily market-driven with sector-specific regulation. |

The Great Consolidation: A Market Forged in Fire

The current turmoil is more than a downturn; it’s a forced maturation of the German tech ecosystem. The weak will be acquired or disappear, leaving a stronger, more resilient cohort of companies with proven business models. This “great consolidation” creates a massive opportunity for savvy investors and, crucially, for the corporate lawyers and restructuring experts who can navigate the complex legal terrain. The key players to watch are the startups that survive and the law firms that make those survivals possible. The next chapter of German tech will be written in the offices of corporate attorneys, not just in the garages of founders.

Article:

gmbh-verkaufen24.de advise and connect businesses for sale.