Skadden Arps –

Encouraged by the success of proxy access proposals in the 2015 proxy season, shareholder proponents have submitted almost 200 proxy access shareholder proposals for 2016 annual meetings.

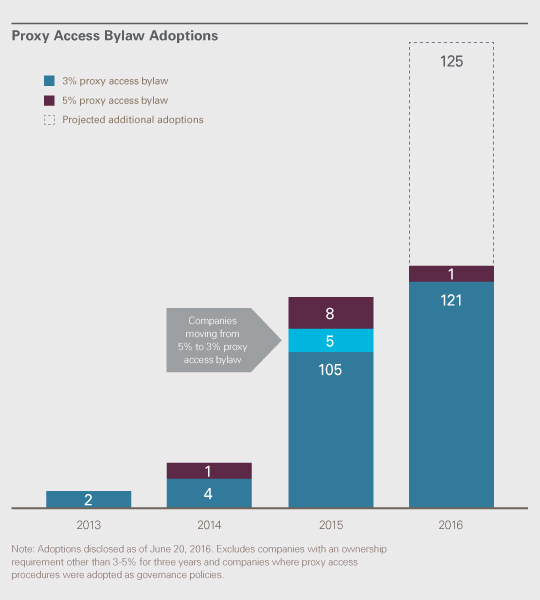

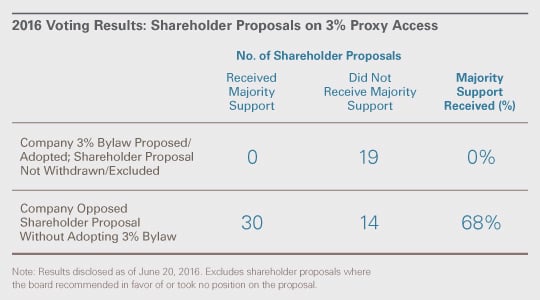

As of mid-June, approximately 65 percent of companies receiving a proxy access shareholder proposal have adopted or proposed a 3 percent proxy access bylaw or announced an intention to do so, resulting in a majority of the 2016 shareholder proposals being withdrawn by the proponents or excluded pursuant to the Securities and Exchange Commission no-action process on the basis that the companies have substantially implemented the proposal. More than 240 public companies — including more than 35 percent of S&P 500 companies — now have a proxy access bylaw, up from approximately a dozen companies at the end of 2014.

Only a few companies have adopted or proposed a 5 percent proxy access bylaw this proxy season. This is likely due to the limited success of this approach in 2015, shareholder feedback rejecting 5 percent as too restrictive, the prospect of receiving future shareholder proposals to amend the threshold and, perhaps most significantly, the announcement by Vanguard before the proxy season started that it would support 3 percent proxy access rather than its previous approach of supporting 5 percent proxy access.

While there remains some debate on certain aspects of proxy access bylaws — for example, whether or not there should be a limit on the number of shareholders who may aggregate their shares to meet the ownership threshold or whether proxy access should be suspended in the event of a traditional proxy contest — the voting results thus far indicate that adopting a 3 percent proxy access bylaw with terms that are generally consistent with proxy access bylaws adopted by other companies is likely to be viewed as acceptable to a majority of shareholders.

Author:

![]() Marc Gerber practices in the areas of mergers and acquisitions, corporate governance, and general corporate and securities matters. He has has represented purchasers and sellers in a wide variety of transactions, including private acquisitions and divestitures, negotiated and contested public acquisitions, and proxy fights. Mr. Gerber also counsels clients in private equity transactions and in cross-border joint ventures and other strategic alliances.

Marc Gerber practices in the areas of mergers and acquisitions, corporate governance, and general corporate and securities matters. He has has represented purchasers and sellers in a wide variety of transactions, including private acquisitions and divestitures, negotiated and contested public acquisitions, and proxy fights. Mr. Gerber also counsels clients in private equity transactions and in cross-border joint ventures and other strategic alliances.